Elon Musk Tesla Stock Inc. (NASDAQ: TSLA) has become one of the most closely watched stocks in the global market, largely due to its revolutionary approach to electric vehicles and the leadership of its CEO, Elon Musk. The company’s stock performance has been characterized by significant volatility, remarkable growth periods, and a strong correlation with both Musk’s public statements and broader electric vehicle market trends.

The Tesla-Musk Connection: Understanding the CEO’s Impact on Stock Performance

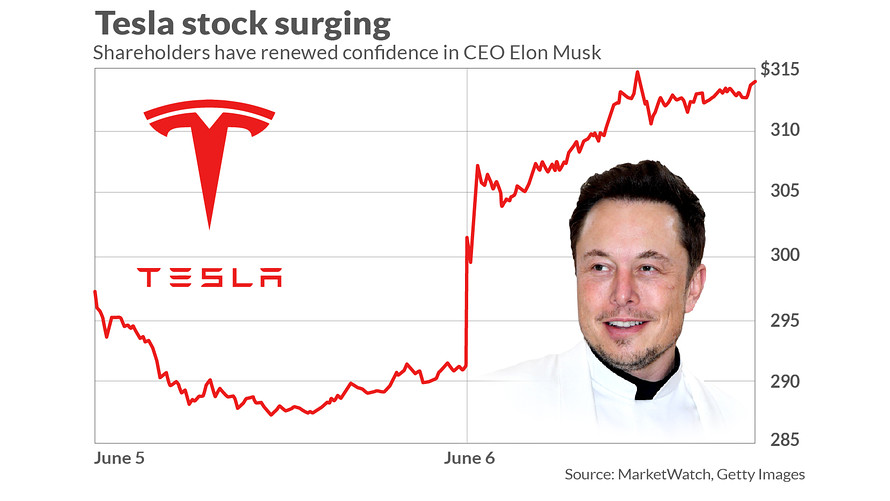

Elon Musk Tesla Stock price cannot be overstated. As both CEO and the company’s largest individual shareholder, Musk’s actions, statements, and even social media posts have historically caused significant market movements. His unconventional leadership style and direct communication approach through platforms like X (formerly Twitter) have created a unique dynamic where investor sentiment can shift rapidly based on his public communications.

The relationship between Musk and Tesla stock has evolved significantly since the company’s initial public offering in 2010. Early investors who believed in Musk’s vision of sustainable transportation have seen extraordinary returns, though the journey has included numerous periods of extreme volatility. Musk’s ambitious production targets, bold predictions about autonomous driving capabilities, and occasional controversial statements have all contributed to the stock’s price movements over the years.

Tesla’s Market Position and Competitive Advantages

Tesla maintains several key competitive advantages that have supported its stock valuation. The company’s vertical integration strategy allows it to control more aspects of production than traditional automakers, from battery manufacturing to software development. This approach has enabled Tesla to achieve industry-leading gross margins on its vehicles, particularly as production has scaled up at its facilities in Fremont, California; Shanghai, China; Berlin, Germany; and Austin, Texas.

The company’s Supercharger network represents another significant competitive moat. With thousands of charging stations globally, Tesla has created infrastructure that enhances the ownership experience and addresses one of the primary concerns about electric vehicle adoption: range anxiety. This network effect becomes more valuable as more Tesla vehicles hit the road, creating a self-reinforcing cycle that benefits both the company and its stock price.

Tesla’s energy storage business, including products like the Powerwall and Megapack, provides diversification beyond automotive sales. This segment has shown strong growth and offers exposure to the broader renewable energy transition, which many investors view as a long-term secular trend supporting Tesla’s valuation.

Financial Performance and Stock Valuation Metrics

Tesla’s financial performance has improved dramatically from its early years of consistent losses to achieving sustained profitability. The company has demonstrated the ability to generate positive free cash flow, allowing it to fund expansion without relying heavily on external financing. This financial stability has been a key factor in supporting the stock price and reducing concerns about the company’s long-term viability.

When analyzing Tesla stock, investors often look at various valuation metrics. The price-to-earnings ratio, enterprise value to sales, and price-to-book ratios all provide different perspectives on whether the stock is fairly valued. Tesla’s valuation has often appeared stretched compared to traditional automakers, but supporters argue that the company should be valued more like a technology company due to its software capabilities, data collection, and potential in autonomous driving.

Revenue growth remains a critical factor for Tesla’s stock performance. The company has consistently delivered strong year-over-year growth in vehicle deliveries and revenue, though the rate of growth has naturally moderated as the company has scaled. Investors closely monitor quarterly delivery numbers, production capacity expansions, and new model announcements as indicators of future growth potential.

Risks and Challenges Facing Tesla Stock

Despite its success, Tesla faces numerous challenges that could impact its stock price. Increasing competition from both traditional automakers and new electric vehicle startups poses a threat to Tesla’s market share. Companies like Ford, General Motors, Volkswagen, and newer entrants like Rivian and Lucid Motors are all investing heavily in electric vehicle technology and production capacity.

Regulatory risks also remain a concern for Tesla investors. Changes in government incentives for electric vehicles, safety regulations, or autonomous driving rules could significantly impact the company’s business model and growth trajectory. Additionally, Tesla’s significant exposure to the Chinese market creates geopolitical risks that could affect production, sales, or supply chains.

Supply chain disruptions and raw material costs, particularly for battery components like lithium, nickel, and cobalt, represent ongoing operational challenges. Tesla’s ability to secure stable supplies of these materials at reasonable costs will be crucial for maintaining profitability as competition intensifies.

Future Outlook and Investment Considerations

The future of Tesla stock depends on several key factors. The company’s ability to successfully launch and ramp production of new models, including the Cybertruck and next-generation vehicles, will be critical for maintaining growth momentum. Progress in autonomous driving technology could unlock significant value if Tesla can successfully deploy a robotaxi service, though the timeline and regulatory approval for such services remain uncertain.

Tesla’s energy business presents additional growth opportunities as global investment in renewable energy infrastructure accelerates. The company’s battery technology and manufacturing expertise position it well to benefit from the broader energy transition beyond just automotive applications.

For potential investors, Tesla stock represents both opportunity and risk. The company’s leadership in electric vehicles, strong brand loyalty, and innovative culture provide reasons for optimism. However, the stock’s volatility, high valuation multiples, and dependence on continued execution excellence require careful consideration of risk tolerance and investment timeline.

Conclusion

Tesla stock remains one of the most fascinating and debated investments in the public markets. Elon Musk’s leadership, while sometimes controversial, has driven the company to achieve what many thought impossible: profitable mass production of electric vehicles that consumers actually want to buy. As the automotive industry continues its transformation toward electrification and autonomous driving, Tesla’s first-mover advantages and technological capabilities position it as a key player in this transition.

Investors considering Tesla stock should carefully evaluate their own risk tolerance, investment goals, and views on the future of transportation and energy. While the company has delivered exceptional returns for early investors, future performance will depend on Tesla’s ability to maintain its competitive advantages while navigating an increasingly complex and competitive landscape. As always, diversification and thorough research remain essential components of any investment strategy, particularly when considering a stock as dynamic and volatile as Tesla.